15+ wa liquor tax calculator

There are two taxes on spirits in Washington. Washingtons general sales tax of 65 also applies to the purchase of beer.

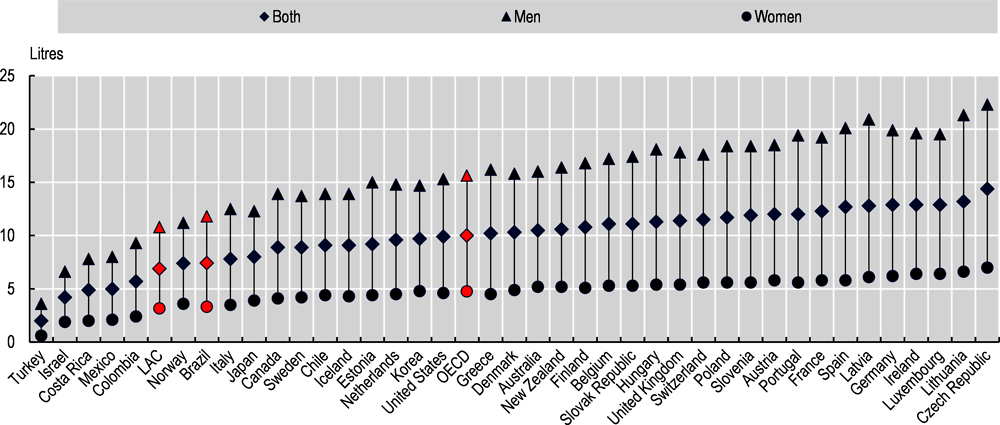

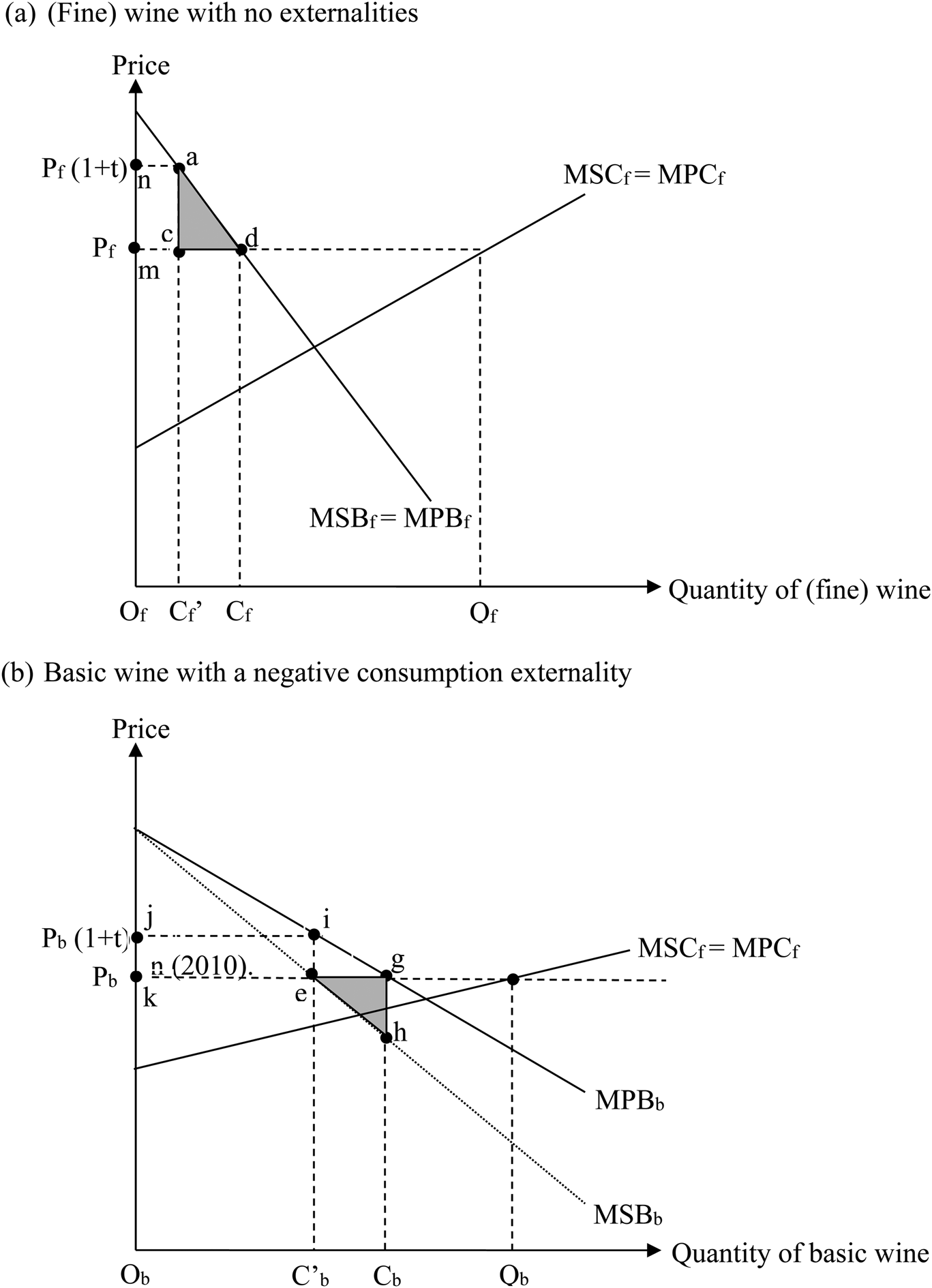

6 The Economics Of Alcohol Consumption In Brazil Oecd Reviews Of Health Systems Brazil 2021 Oecd Ilibrary

Washingtons general sales tax of 65 also applies to the purchase of beer.

. Shortcuts for prices ending in 00 99 and. This simple app does one thing -- lets you input the price and size of the bottle of liquor and then it tells you the total cost. You can total the cost of 1 2 3 or as many as.

Sales tax rate sales tax percent 100. The tax rate for on-premises retailers such as restaurants bars etc is 24408 per liter. The tax rate for on-premises retailers such as restaurants bars etc is 137 percent.

Washington State Liquor Tax Calculator. Washington recently privatized liquor sales and with it came a new pricing structure for liquor. Calculate total liquor cost in all 50 states without going to the register.

If you sell spirits you will collect the spirits liter tax from your customer and remit. Washington State Spirits Tax. Find out with the WA Liquor Tax Calculator.

Eg Enter a ten-cent tax. You have to enter a decimal number with dollars and cents ya jack-tard. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

Quickly calculate the total price including sales tax and volume tax of liquor sold in the state of washington in as little as four taps. Since spirits purchases made by licensed on-premises. The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars.

You can total the cost of 1 2 3 or as many as. Sales Tax Calculation Formulas. 350barrel applies to the first 60000 barrels for a domestic brewer who produces less than 2 million barrels per year.

Total price including tax. Federal excise tax rates on beer wine and liquor are as follows. 1800 per 31-gallon barrel or 005 per 12-oz can.

Sales tax list price sales tax rate. The tax rate for sales to consumers is 205 percent. Quickly calculate the total price including sales tax and volume tax of liquor sold in the State of Washington in as little as four taps.

You can total the cost of 1 2 3 or as many as. 70 455 7455. How do I pay the tax.

Wa liquor tax calculator 11 update. Enter tax or fee increase for one or more alcohol categories. Add tax to list price to get total price.

If the tax had kept pace with inflation instead of 105 per gallon it would now be 000 per gallon. Fifth 750ml mini 50ml half pint 200ml pint 375ml fifth 750ml 1 liter half gallon 175l gallon 35l Quickly calculate the. Wa liquor tax calculator 11 update.

16barrel applies to the first. In Washington liquor vendors are responsible for paying a state excise tax of 1427 per gallon plus Federal excise taxes for all liquor sold.

6 The Economics Of Alcohol Consumption In Brazil Oecd Reviews Of Health Systems Brazil 2021 Oecd Ilibrary

Washington State Liquor Tax Apps On Google Play

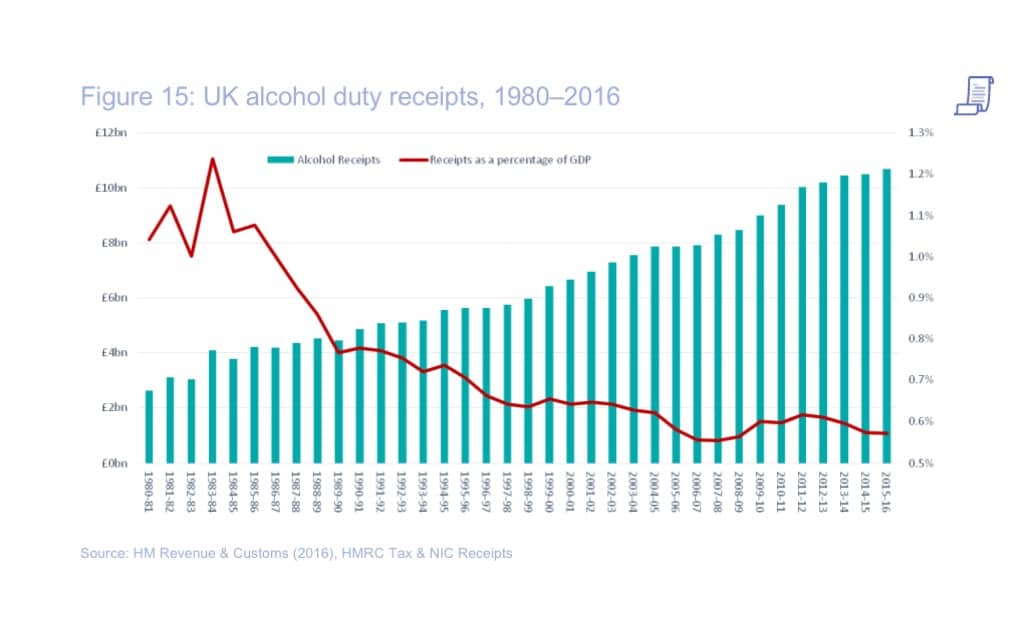

Pros And Cons Of Higher Tax On Alcohol Economics Help

Washington Sales Tax Calculator And Local Rates 2021 Wise

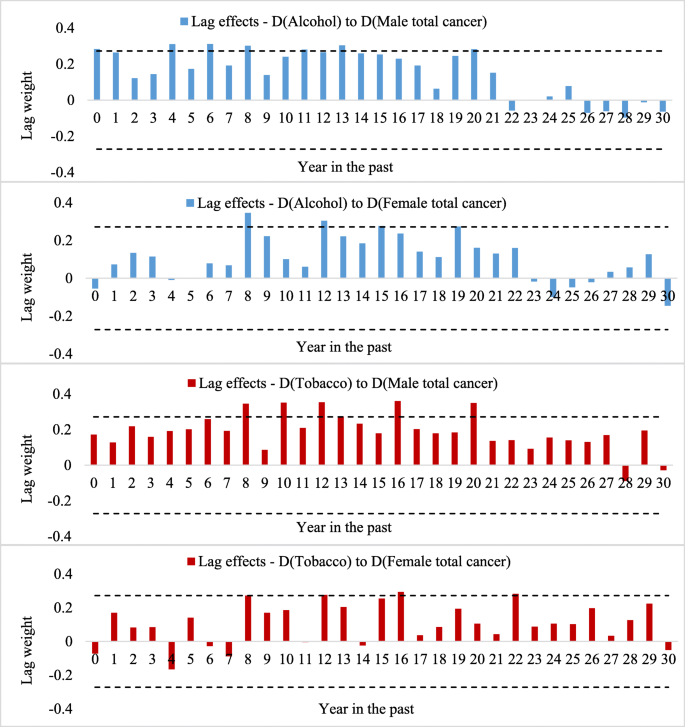

Effects Of Changes To The Taxation Of Beer On Alcohol Consumption And Government Revenue In Australia Sciencedirect

Can Public Health Policies On Alcohol And Tobacco Reduce A Cancer Epidemic Australia S Experience Bmc Medicine Full Text

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Washington Income Tax Calculator Smartasset

Underage Access To Alcohol And Its Impact On Teenage Drinking And Crime Sciencedirect

History Of Alcoholic Drinks Wikipedia

Latvia Lv Alcohol Consumption Rate Projected Estimates Aged 15 Male Economic Indicators Ceic

Pdf The Pass Through Of Alcohol Taxes To Prices In Oecd Countries

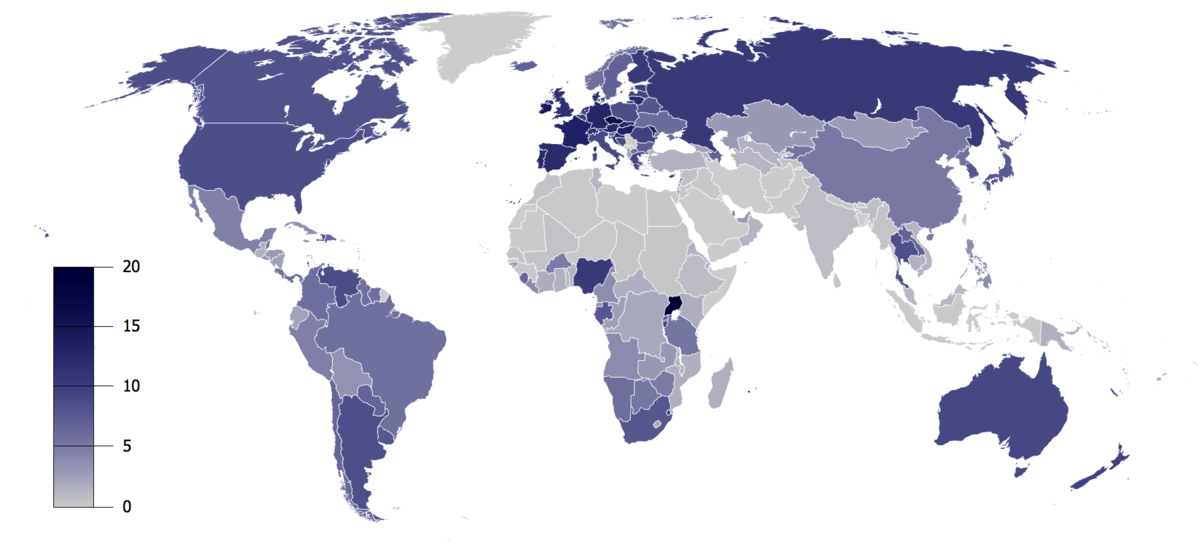

Consumer Taxes On Alcohol An International Comparison Over Time Journal Of Wine Economics Cambridge Core

How To Calculate Excise Duty On Alcohol Foodnomy

1289 Gif

Tzzfzjdbaywtjm

![]()

Washington State Liquor Tax Calculator By Frank Schmitt